Structure with Confidence: Trust Foundations

Structure with Confidence: Trust Foundations

Blog Article

Safeguarding Your Possessions: Trust Fund Foundation Proficiency within your reaches

In today's complicated economic landscape, making sure the safety and development of your properties is extremely important. Depend on structures serve as a foundation for securing your riches and heritage, offering an organized strategy to possession defense.

Significance of Count On Foundations

Depend on foundations play a crucial duty in developing reliability and fostering strong connections in numerous specialist setups. Count on foundations serve as the cornerstone for ethical decision-making and clear interaction within companies.

Benefits of Specialist Advice

Structure on the foundation of count on professional partnerships, seeking expert assistance uses important advantages for people and organizations alike. Specialist guidance provides a wealth of understanding and experience that can aid navigate intricate monetary, lawful, or tactical obstacles effortlessly. By leveraging the know-how of professionals in various areas, people and companies can make enlightened decisions that straighten with their goals and goals.

One significant benefit of expert support is the capacity to gain access to specialized expertise that might not be conveniently offered or else. Experts can use understandings and point of views that can cause ingenious solutions and possibilities for growth. Additionally, collaborating with specialists can help mitigate threats and unpredictabilities by giving a clear roadmap for success.

Moreover, specialist support can save time and resources by streamlining procedures and avoiding pricey errors. trust foundations. Specialists can provide tailored recommendations tailored to specific demands, guaranteeing that every decision is educated and strategic. In general, the advantages of professional advice are complex, making it a valuable possession in safeguarding and maximizing properties for the long term

Ensuring Financial Protection

In the realm of economic planning, protecting a stable and flourishing future joints on critical decision-making and sensible financial investment options. Making sure monetary safety entails a complex method that includes different facets of riches management. One critical component is producing a varied financial investment profile customized to individual risk resistance and economic objectives. By spreading out financial investments throughout different asset classes, such as stocks, bonds, realty, and assets, the risk of significant monetary loss can be minimized.

In addition, preserving an emergency fund is necessary to secure against unforeseen expenses or revenue disturbances. Specialists suggest setting apart 3 to 6 months' well worth of living costs in a fluid, quickly obtainable account. This fund works as a financial safety net, supplying satisfaction throughout rough times.

Frequently assessing and changing economic plans in response to transforming circumstances is likewise vital. Life events, market fluctuations, and legislative modifications can impact financial stability, highlighting the relevance of continuous analysis and adjustment in the pursuit of long-lasting monetary safety - trust foundations. By carrying out these techniques attentively and continually, people can strengthen their monetary ground and work towards pop over to these guys an extra safe and secure future

Guarding Your Possessions Successfully

With a solid structure in place for economic security through diversity and emergency fund upkeep, the next vital step is guarding your properties properly. Securing possessions includes safeguarding your wealth from prospective threats such as market volatility, economic recessions, lawsuits, and unforeseen expenses. One effective strategy is possession allowance, which includes spreading your financial investments throughout different property classes to lower risk. Expanding your profile can assist minimize losses in one area by balancing it with gains in an additional.

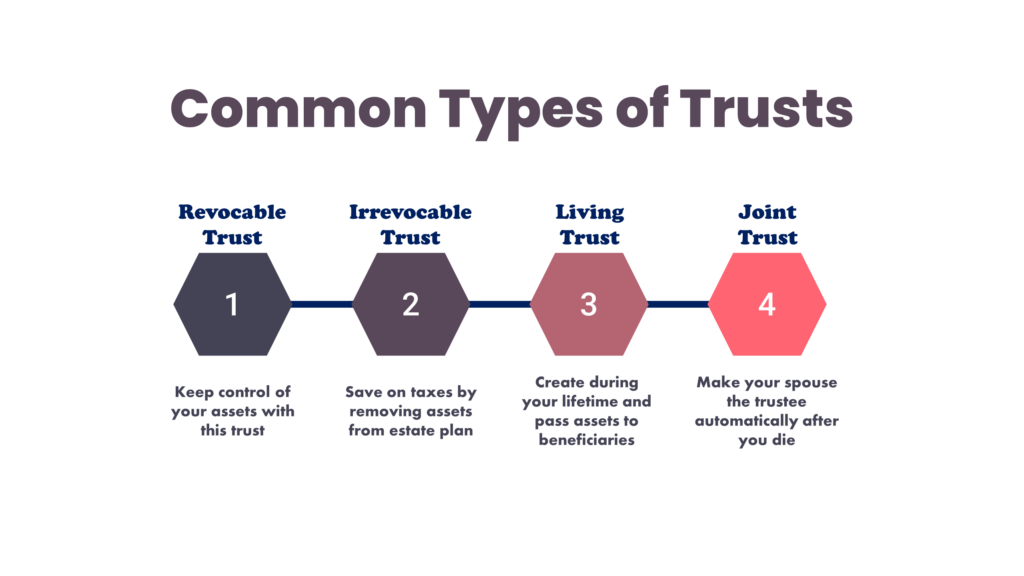

In addition, establishing a count on can offer article a safe and secure means to secure your properties for future generations. Trusts can aid you regulate exactly how your possessions are dispersed, reduce inheritance tax, and protect your riches from financial institutions. By applying these methods and seeking expert guidance, you can safeguard your properties effectively and protect your financial future.

Long-Term Property Defense

To make sure the enduring protection of your wealth against potential risks and uncertainties over time, calculated planning for long-lasting asset defense is essential. Lasting asset security entails executing steps to secure your possessions from different hazards such as financial slumps, suits, or unanticipated life occasions. One important facet of long-lasting possession defense is establishing a trust fund, which can provide significant benefits in shielding your assets from creditors and legal conflicts. By moving possession of properties to a count on, you can safeguard them from potential risks while still retaining some degree of control over their administration and distribution.

In addition, diversifying your investment portfolio is another crucial strategy for long-lasting asset defense. By taking a proactive strategy to long-lasting asset protection, you can protect your wide range and supply economic protection for yourself and future generations.

Conclusion

To conclude, trust fund foundations play a critical function in safeguarding properties and guaranteeing economic safety. Professional assistance in establishing and handling trust fund structures is vital useful link for lasting property security. By making use of the knowledge of specialists in this area, people can effectively guard their possessions and prepare for the future with confidence. Trust structures supply a solid structure for shielding riches and passing it on future generations.

Report this page